A Review of North Carolina Venture Capital Tech Investing

From 2009 to the First Half of 2012

|

BY ZACK MANSFIELD •

@zackmansfield •

7.18.12

| |||||||||||||||||

Filed Under: NEWS: Startups

In my role working with startups in the NC startup ecosystem, one of the constant cries and concerns I hear from entrepreneurs is that there is not enough investment capital available, especially for early stage companies.

In my role working with startups in the NC startup ecosystem, one of the constant cries and concerns I hear from entrepreneurs is that there is not enough investment capital available, especially for early stage companies. As participants in a relatively smaller entrepreneurial ecosystem – compared to the mammoth markets of Silicon Valley, Boston and New York – it's an easy conclusion to come to. And the reality is that there is a concerning lack of resident venture funds. However, we all know that entrepreneurs are nothing if not persistent and there continue to be individuals working tirelessly to grow startup ventures which will need capital in order to grow.

So literally on a daily basis I'm meeting with entrepreneurs and doing my best to understand what their capital needs might be and trying my hardest to use the market knowledge available to figure out what group or individual might be the right fit as a capital source and partner.

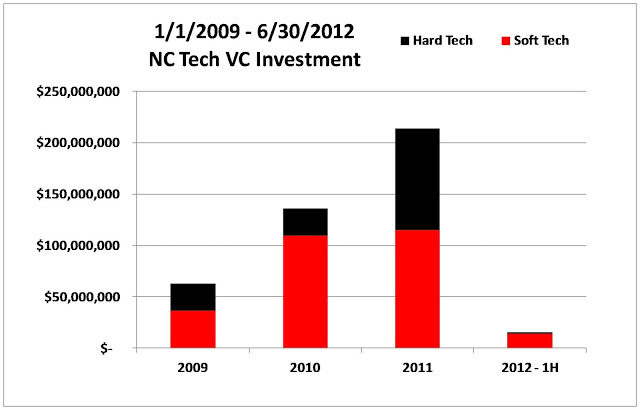

In order to provide meaningful feedback in this cause, it's important to understand who does have an appetite for investing in this region. A little more than a year ago I spent some time and wrote a couple blog posts on the venture capital activity within tech companies in North Carolina over the prior three years.

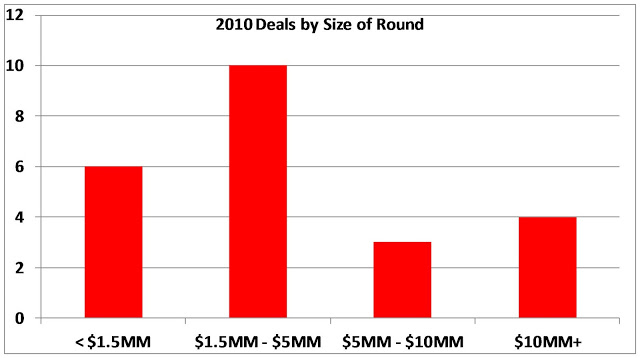

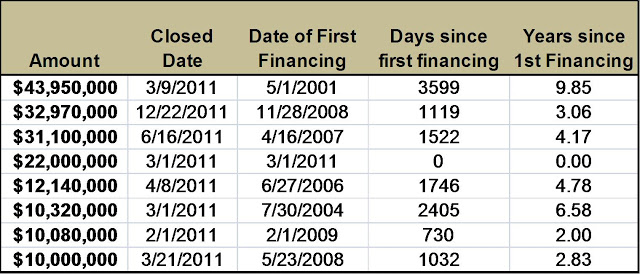

Recently, I spent some more time looking at the companies that were able to secure funding during 2011 and the first half of 2012 and hope the following data points will prove helpful in understanding what the market looks like today.

Before we dive in, a bit of commentary on the methodology and data that was used.

I chose again to limit the conversation to institutional investments in “tech”, and to break up the analysis between “hard” and “soft” tech. Broadly speaking, “hard” technologies include semiconductors, materials, & sensors. “Soft” technologies include internet/web services, mobile, technology enabled services, e-commerce, and healthcare IT. This analysis does not include life sciences or medtech transactions.

For a full breakdown of the methodology and rationale I invite you to see my post from last year on the subject. Also, a hat tip to Square 1 intern Abbey Wells who did fantastic work helping me to compile this data - thanks Abbey!

On to the data:

Companies We Mentioned In This Post

Acorn Innovestments |

Aurora Funds |

| |||

Frontier Capital |

|

Intersouth Partners | |||

|

Overture Networks |

| |||

|

|

You Might Also Be Interested In

Startups Are Like Marathons

Startups Are Like MarathonsAbout a year ago, Mark decided that he needed to scratch the entrepreneurial itch fully, and left the bank to join one of his startup clients, Updater.

Three Tips for Breaking Into the Startup World

Three Tips for Breaking Into the Startup WorldFrom time to time, I'll meet someone who wants to break into the startup world. I usually try to ask a series of questions to understand exactly what the person wants to do and then attempt to do some mental matching with companies that may be a fit.

The New Year is upon us which means every treadmill at the local gym is occupied by an eager soul hoping to fulfill some sort of resolution. I have to admit, I'm a sucker for resolutions and even went as far last year as going public with them.

Is the Startup Conference Model Broken?

Is the Startup Conference Model Broken?The startup world is currently in one of the unofficial “Conference Seasons” - the couple month period after summer and before the holidays when there is a seemingly endless stream of venture conferences, industry events and networking opportunities.

Everything's Amazing and Nobody's Happy

Everything's Amazing and Nobody's HappyHow do we navigate this world then, especially as a startup knowing what we do regarding just how difficult the road will be?